Residential Mortgage

Single Family, Condo, Townhouse, Co-op & Multi Family House

We are offering home loan programs in collaboration with Loan Factory. Loan Factory is a highly reputable mortgage brokerage company that has been operating in the United States for over 18 years, boasting a perfect 5-star Google rating with over 10,000 reviews. The company ranks among the top 1 or 2 home loan brokerages nationwide, comparing and providing competitive low interest rates and tailored terms for each client from a selection of 240 diverse mortgage loan products.

With our 20 years of experience in real estate and financial lending, combined with our dedication and integrity, we utilize Loan Factory’s cutting-edge technology, systems, and excellent programs to provide the best possible service to each and every customer. We are committed to helping you take the first step toward achieving your American Dream.

Types of Home Mortgages

Conventional Loan

- QM = Qualified Mortgage (Standard loan guidelines set by the government)

Operated by private financial institutions without government backing

Based on Fannie Mae and Freddie Mac guidelines

Available as Fixed Rate or Adjustable Rate (ARM)

Minimum down payment starts at 3%

No PMI required with a down payment of 20% or more

Higher credit scores qualify for lower interest rates

Minimum credit score: 620

Requires 2 years of income documentation

Eligible for primary residence, second home, or investment property

Repayment terms: 15 to 30 years

Non-QM Loan

- Non-QM = Loans that do not meet standard (Qualified Mortgage) guidelines

Uses alternative documents instead of traditional tax returns (1040, W-2), such as bank statements, P&L, or rental income – ideal for self-employed or freelancers

Bank Statement Loan – Income verified through bank deposits

Asset Depletion Loan – Income calculated based on liquid assets

DSCR Loan – Qualification based on rental income only (for investment properties)

Foreign National Loan – Loans for non-U.S. residents

Interest-Only Loan – Pay only interest for the first few years

Easier approval criteria, but interest rates are slightly higher than conventional loans

Lower credit scores may be accepted

Down payment typically ranges from 10% to 30%, depending on the program

FHA Loan

- Federal Housing Administration (FHA) – Government-Backed Mortgage Program

Allows home purchase with a low down payment

Designed for borrowers with lower credit scores

3.5% down payment with credit score of 580 or higher

10% down payment with credit score of 500 or higher

MIP (Mortgage Insurance Premium) is required

Ideal for first-time homebuyers

Renovation costs can be included

Offers some of the lowest interest rates

Loan limits vary by county

USDA Loan

- USDA Rural Housing Loan Program

Offered by the U.S. Department of Agriculture (USDA)

Designed for rural and low-population areas

Allows home purchase with no down payment

Must meet income limits and regional eligibility requirements

Only available for primary residence (not for investment properties)

Borrower must be a U.S. citizen or legal resident

VA Loan

- Veterans Affairs (VA) – Government-Backed Mortgage Program

Requires a VA Certificate of Eligibility (COE)

→ Applicants must obtain a certificate from the VA confirming eligibilityAvailable to active-duty service members, veterans, and surviving spouses

No down payment required

No mortgage insurance (MIP)

Flexible credit requirements – 580 or higher

Offers some of the lowest interest rates

Instant Quick Quote

You can check today’s mortgage rates instantly in 3 different ways.

Compare interest rates, fees, monthly payments, and closing costs for various programs. No documents needed — just answer a few quick questions to get your quote right away. If you need help while filling out the questions, call us at (631) 624-4480.

1. Scan the QR code with your phone to use the Loan Factory app

2. Click the blue button below labeled "Mortgage Rate - Instant Quote"

3. Call (631) 624-4480

FAQ (Frequently Asked Questions):

Mortgage interest rates fluctuate daily and vary depending on the type of mortgage, program, product, and individual circumstances. Factors such as personal credit score, income, down payment, current situation, and future plans will influence the choice of mortgage type, program, or product.

Generally, when considering only interest rates, adjustable rates tend to be lower than fixed rates, and shorter terms (such as 20 or 15 years) typically have lower rates than 30-year terms. Conventional QM (Qualified Mortgage) programs also tend to have lower rates than Non-QM (Non-Qualified Mortgage) loans. However, it’s important to consider monthly payments and choose a program that aligns with your individual situation and future plans. We recommend getting a free consultation and obtaining a Pre-approval to find out the interest rate and loan amount you qualify for.

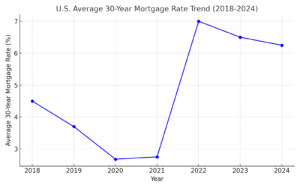

*U.S. Average 30-Year Mortgage Rate Trend (2018 – 2024):

2024 (Current): 5.95% – 6.25%

2023: 6.5% – 7.5%

2022: 6% – 7%

2020-2021: 2.65% – 3.2%

2018-2019: 4.5% – 5%

Income Verification:

When applying for a loan, the most important factor is demonstrating the ability to repay. You will need the past two years of tax returns and the most recent month’s pay stubs. The loan amount and monthly payment are determined based on the remaining balance after subtracting monthly expenses from monthly income. Depending on the ratio of monthly mortgage payments (principal + interest + taxes + insurance) to monthly income, different loan programs or products may be available.

Monthly Income – Monthly Expenses = Loan Amount and Monthly Payment Calculation

Reducing Monthly Expenses:

Even with a high income, it can be challenging to secure a loan if monthly expenses are high. This is because the loan amount and monthly payment are based on the remaining income after monthly expenses. The lower the monthly expenses, the more favorable the loan amount and monthly payment. It’s advisable to reduce expenses in advance to improve your chances.

Down Payment:

Down payments usually starts from as low as 3%. For conventional home loans, if the down payment is below 20%, you will need to pay for private mortgage insurance (PMI) or mortgage insurance premium (MIP for FHA loans) each month.

Typically, home loans require two months of bank statements. 401K retirement funds and gifts from family members are acceptable, but other deposits may need to be tracked for funding sources. Preparing these in advance can help prevent delays.

Closing Costs:

In addition to the down payment, closing costs are also required for a home loan. While this can vary by situation, a general estimate is around 3% – 5% of the loan amount. However, when there isn’t much extra cash available, you can opt for a loan with no or low fees, even if the interest rate is slightly higher. Closing costs include various fees, mortgage escrow, insurance, and any pre-paid taxes by the seller. Make sure to have the necessary funds prepared.

Closing Cost: All fees + Insurance + Escrow + Pre-paid Taxes

Personal Credit:

The interest rate and loan terms can vary depending on your personal credit score. A higher credit score means lower loan risk, leading to better interest rates and terms. It’s beneficial to check your credit in advance and resolve any issues if needed.

You can check your credit for free once a year from all three major bureaus (Experian, TransUnion, Equifax).

There are countless mortgage products available in the United States. Unlike being limited to the programs of a single bank, we compare mortgage programs from approximately 199 financial institutions, including a variety of wholesale mortgage banks, credit unions, online lenders, and private lenders across the country. This allows us to provide options that enable each individual to select the most suitable terms. As a mortgage-specialized company, we support our clients in choosing the most favorable conditions for their unique situations.

When comparing mortgages, it’s essential to consider not just the interest rate but also lender credits and points. The APR (Annual Percentage Rate) reflects the comprehensive rate, including both the interest rate and lender points, making it a more accurate standard for comparison. We assist you in easily comparing various interest rates, fees, lender credits, and points tailored to your specific circumstances. You can use our instant mortgage rate quote tool or contact us directly, and we’ll help you review and compare different mortgage rates.

The U.S. government encourages shopping around for mortgages. According to research by the CFPB (Consumer Financial Protection Bureau), shopping around for multiple mortgage options can result in an average reduction of 0.5% in the interest rate. A 0.5% difference in interest rates is not a small amount for individuals. From the initial consultation to the final step, we are committed to providing you with dedicated support.

When purchasing a home, the minimum down payment required for a conventional loan is typically 3%. However, if the down payment is less than 20%, you will need to pay for Private Mortgage Insurance (PMI) on a monthly basis. Alternatively, you can take out a piggyback loan to meet the 20% requirement and avoid PMI. It’s important to have the down payment funds in your personal bank account at least two months prior to avoid issues with fund verification. Please plan and prepare ahead of time.

Closing Costs:

In addition to the down payment, closing costs are also required for a home loan. While this can vary by situation, a general estimate is around 3% – 5% of the loan amount. However, when there isn’t much extra cash available, you can opt for a loan with no or low fees, even if the interest rate is slightly higher. Closing costs include various fees, mortgage escrow, insurance, and any pre-paid taxes by the seller. Make sure to have the necessary funds prepared.

Closing Cost: All fees + Insurance + Escrow + Pre-paid Taxes

Down Payment Assistance Programs:

Especially for first-time homebuyers, there may be down payment assistance programs available at the state, city, or county level. In some cases, employers may also provide partial down payment assistance. A first-time homebuyer is defined as someone who has not owned a home in the past three years and may be eligible for various benefits when applying for a mortgage.

Gift Funds from Family:

You can receive down payment funds as a gift from close family members. In this case, a signed gift letter from the donor is required.

Loan Differences Based on Occupancy Purpose:

The down payment requirements differ depending on whether the home is being purchased as a primary residence or for investment or rental purposes. Investment properties may require a higher down payment.

U.S. Government Loan Programs:

FHA Loan (Federal Housing Administration):

If you have a low credit score or a smaller down payment, an FHA loan may be a good option. The FHA loan is a government-backed mortgage insured by the Federal Housing Administration.

- 3.5% down payment for credit scores of FICO 570 or higher

- 10% down payment for credit scores of FICO 500 or higher

VA Loan (Veterans Affairs):

Available to former or active U.S. military personnel, VA loans are government-backed and may offer the option to purchase a home with no down payment.

USDA Loan (U.S. Department of Agriculture):

This program supports home loans for low-to-moderate income buyers in rural areas, with no down payment required in eligible regions.

The first step in purchasing a home is to obtain a mortgage pre-approval. Through pre-approval, your income and credit score are evaluated, allowing you to determine how much you can borrow and what your monthly payments will be. This makes the home shopping process more efficient and saves time.

A free consultation can help calculate your income and expenses to determine your maximum monthly payment. A detailed Pre-approval Letter can give you a competitive edge when submitting an offer to purchase a home.

Once you’ve decided on a property and submitted the required documents and application, you can receive a Loan Estimate (LE) within 3 days. The Loan Estimate includes all details about the loan, such as the interest rate, monthly payments, repayment term, and the closing fees. In addition, you can compare multiple pre-approvals and select the loan with the best terms that are suitable for your personal situation and plans.

Consultations can be done over the phone, and applications can be completed via KakaoTalk or video call. Documents are exchanged via email.

Documents needed for pre-approval:

- Tax returns: Last 2 years

- Pay stubs: Last 1 month

- Bank statements: Last 2 months

- ID: Driver’s license or passport

Refinance for Better Terms Than Your Current Mortgage:

You can consider refinancing if you want to lower your interest rate or reduce your monthly payments. You can also switch from a fixed interest rate to an adjustable one, or vice versa, and shorten your repayment term from 30 years to 20 or 15 years.

Cash-Out Refinance:

Cash-out refinancing allows you to withdraw the accumulated equity in your home as cash.

Equity = Home Value – Outstanding Loan Balance (Debt)

We provide various options to help you choose the best terms for your individual situation and strive for a fast closing process.

If you already have a mortgage and have sufficient equity in your home, you may qualify for a second mortgage or junior mortgage.

Home Equity Loan (HELOAN):

This loan allows you to borrow a lump sum and repay it in fixed monthly installments over a set repayment period.

Home Equity Line of Credit (HELOC):

With a Line of Credit account, you can borrow only the amount you need and pay the minimum interest on the amount used. This is a revolving account, meaning once you repay the borrowed amount, you can borrow again. Typically, after a 10-year revolving period, the remaining balance must be repaid over the next 10 to 20 years.

When applying for a mortgage loan, the most important factors considered by lenders are your repayment ability and credit score. The higher your credit score, the more likely you are to receive better terms and a lower interest rate.

For conventional mortgages, a minimum FICO credit score of 620 is typically required. However, FHA government loans allow for lower credit scores.

FHA Loan (Federal Housing Administration):

If you have a low credit score or a smaller down payment, an FHA loan may be a good option. The FHA loan is a government-backed mortgage insured by the Federal Housing Administration.

- 3.5% down payment for credit scores of FICO 570 or higher

- 10% down payment for credit scores of FICO 500 or higher

The U.S. government encourages mortgage shopping. During a 45-day mortgage shopping period, multiple credit inquiries from various lenders are considered as a single inquiry. Therefore, you don’t need to worry about your credit score being negatively impacted by multiple inquiries while mortgage shopping.

Fixed Interest Rate:

A fixed interest rate provides stability as it remains unchanged throughout the loan term. While monthly payments may be higher compared to adjustable rates, it is advantageous if you plan to stay in the home long-term or have a stable income. If you want to lower your interest rate, you would need to go through a refinance.

Adjustable/Variable Interest Rate:

An adjustable interest rate starts with a fixed rate for the first few years (typically 3 to 10 years), after which it fluctuates based on market conditions. The initial interest rate is generally lower than a fixed rate, making it suitable for short-term stays. However, choosing it solely for the lower rate can be risky in the long term if the rates increase.

When an Adjustable Rate is Favorable:

- If you plan to sell the house within 10 years

- If you plan to refinance within 10 years

- If you need a larger loan amount than what a fixed-rate loan offers

If an individual’s credit score is below FICO 620 and the down payment is low, there is a mortgage loan program insured by the Federal Housing Administration (FHA) for first-time home buyers (those who have not owned a home in the past three years). This program aims to help low- to middle-income individuals achieve homeownership.

FHA (Federal Housing Administration) Loan:

Low Initial Cash Requirement: If your credit score is 580 or above, a down payment as low as 3.5% is possible. For a minimum credit score of FICO 500, a 10% down payment is required. Each state, county, city, or town may offer down payment assistance programs, so it’s worth checking availability.

Flexible Credit Requirements: FHA loans allow for lower credit scores than conventional loans, making them accessible to those with limited credit history or previous credit issues.

Mortgage Insurance: FHA loans require borrowers to pay mortgage insurance premiums (MIP) as protection against default. This premium is paid once at the time of the loan and then included in monthly payments.

Loan Limits: FHA loans have limits that vary by region to prevent them from being used for high-cost properties.

Renovation Cost Inclusion: Renovation costs for the home can also be added to the loan.

For conventional mortgage loans, income verification typically requires 2 years of tax returns, W2s, and pay stubs. However, for self-employed individuals or freelancers who have been in business for over 2 years, income verification can be done using bank statements or 1099 forms instead. This often shows a higher income compared to tax returns. In this case, a Non-QM (Non-Qualified Mortgage) product is used, and a down payment of 10%-25% is required.

For those who have been living in the U.S. and consistently filing taxes for over 2 years but do not yet have a Social Security Number (SSN), it is possible to obtain a mortgage using an ITIN (Individual Tax Identification Number). In this case, a Non-QM (Non-Qualified Mortgage) product is used, and 2 years of tax returns along with a down payment of 10%-20% are required.

Foreign nationals residing outside the U.S. can also obtain a mortgage for investment properties. A Non-QM (Non-Qualified Mortgage) loan is available, requiring a 25%-30% down payment. The required documents include a passport, bank statements, a U.S. bank account, and proof of income.

A Reverse Mortgage is a financial product where elderly homeowners use their home as collateral to receive a loan from a financial institution. Unlike a traditional mortgage, a reverse mortgage allows the borrower to receive monthly payments or a lump sum from the lender, using the home as collateral. The borrower does not have to repay the loan as long as they continue living in the home. Repayment is required when the borrower either sells the home or passes away.

Features of a Reverse Mortgage:

Eligibility Requirements: Generally, homeowners aged 62 or older can apply for a reverse mortgage.

Loan Repayment: The borrower can continue living in the home, and the loan is repaid when the borrower sells the home or passes away. Even if the loan balance exceeds the home’s value, the borrower is not required to pay the excess amount.

Payment Methods: The loan can be received in the following ways:

- Monthly payments

- Lump sum

- Line of credit, allowing withdrawals as needed

Homeownership Maintenance: The borrower remains the owner of the home and is responsible for ongoing costs such as property taxes, insurance, and maintenance.

Interest and Loan Repayment: The interest accrued on a reverse mortgage is added to the loan balance and is not repaid during the loan term. The loan is typically repaid from the proceeds of the home sale.

A reverse mortgage can be a way for elderly homeowners with no or limited income to access the equity in their home for cash. However, borrowers must continue to cover the costs of maintaining the home, and there is a risk that the loan balance may exceed the home’s value.

There are several economic and personal benefits to purchasing a home. Here are the key advantages:

Economic Benefits:

Building Equity: Each monthly mortgage payment contributes to building your home equity. Over time, this can grow into substantial wealth.

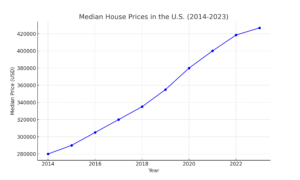

Appreciation in Value: Real estate tends to appreciate in value over time, which means you can potentially sell your home for a profit. Recently, home prices have risen significantly and quickly (see chart below).

Fixed Monthly Payments: With a fixed-rate mortgage, your housing costs remain consistent each month. Unlike rent, which can increase annually, owning a home protects you from this risk.

Tax Benefits: Homeowners can receive tax deductions on mortgage interest and property taxes, which can reduce overall tax liability.

Potential Rental Income: If you have extra space or own a second property, you can rent it out to generate additional income.

Personal Benefits:

Stability: Owning a home allows you to stay in one place for a long period, providing a sense of stability. You also have the freedom to renovate and customize your home to suit your personal preferences.

Sense of Accomplishment: Homeownership can bring a sense of pride and accomplishment. For many, it is an important milestone in life.

Control Over Your Environment: Unlike renting, owning a home gives you control over modifications and repairs without needing approval from a landlord.

Privacy: Owning a home typically offers more privacy compared to living in rental apartments or condos.

Community Engagement: Homeownership often fosters stronger connections with neighbors and the local community, leading to a greater sense of belonging.

Terry Kwon – Licensed Mortgage Loan Originator

Loan Factory is a residential mortgage brokerage company with over 18 years of history and ranks among the top 1, 2 mortgage brokerages in the U.S. Loan Factory collaborates with over 199 wholesale mortgage lenders to offer the most competitive and favorable terms to its clients. Additionally, Loan Factory holds licenses in 48 states across the U.S. and is a highly recognized company with more than 8,000 positive Google reviews and a perfect 5-star rating.

Home Mortgage Blog by Terry

Mortgage Options for Self-Employed Buyers in the U.S.

💼 A Complete Guide to Mortgage Options for Self-Employed Buyers in the U.S. – What if your reported income is low or your

The Impact of Personal Credit on Loans and How to Maintain a Good FICO Credit Score, Plus the Three Major U.S. Credit Bureaus:

The Impact of Personal Credit on Loans and How to Maintain a Good FICO Credit Score, Plus the Three Major U.S. Credit Bureaus:

Should I buy a house? Can I buy a house? When and how should I buy one?

Should I buy a house?Can I buy a house?When and how should I buy one? Should I buy a house?